Asian equities see largest monthly foreign inflow in 15 months

ASIAN equities attracted strong foreign inflows in May as concerns over an immediate economic hit from higher U.S. tariffs eased, prompting a return by investors who had previously exited large and concentrated positions in the region.

The inflows marked a sharp reversal after four consecutive months of net foreign selling.

According to data from LSEG, foreign investors bought approximately $10.65 billion worth of equities across India, Taiwan, South Korea, Thailand, Indonesia, Vietnam, and the Philippines, registering their largest monthly net purchase since February 2024.

U.S. President Donald Trump’s announcement of reciprocal tariffs in early April stoked concerns over the impact on Asian exports, exporter margins, and regional supply chains, but a subsequent 90-day pause for most countries later in the month helped ease investor fears and revive interest in regional assets.

Goldman Sachs said it has revised its earnings growth forecast for MSCI Asia Pacific ex-Japan (MXAPJ) to 9% for both 2025 and 2026, raising estimates by 2 and 1 percentage points, respectively, citing stronger macro growth in China and U.S.-exposed markets.

The upgrade was also supported by $600 billion in AI-related investments from Saudi Arabia to U.S. firms, which are expected to benefit Taiwan and Korea, though the impact may be partially offset by a weaker dollar, the brokerage said.

Taiwan equities witnessed $7.28 billion worth of foreign inflows, the largest monthly cross-border net purchase since November 2023.

Foreigners also acquired a significant $2.34 billion worth of Indian stocks in their largest monthly net purchase since September 2024.

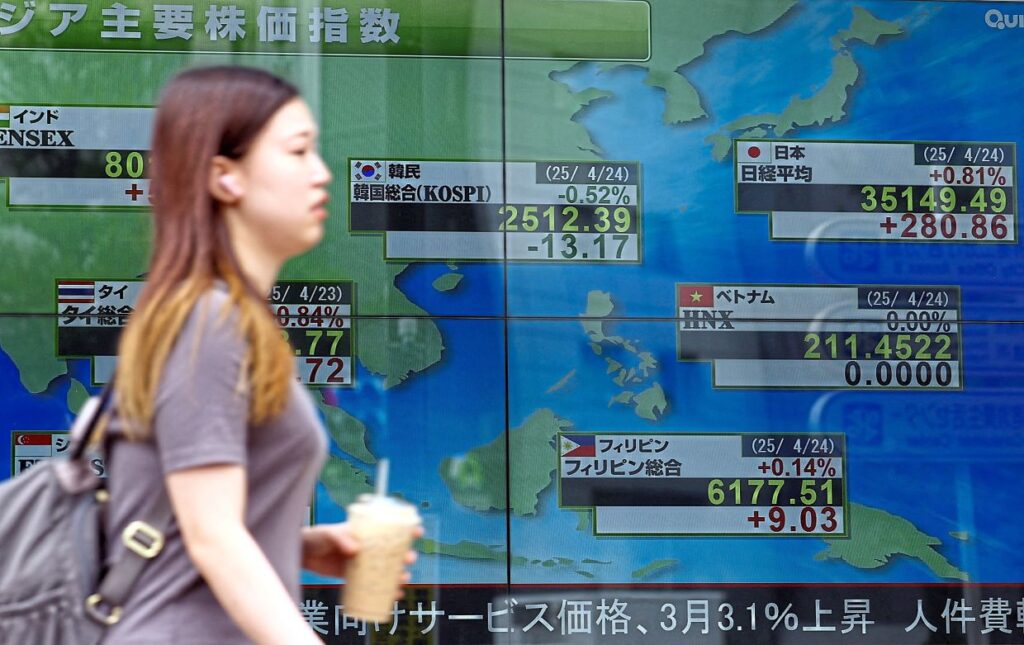

South Korean, Indonesian and Philippine stocks also saw foreign inflows worth a net $885 million, $338 million and $290 million, respectively, while Thai stocks suffered $491 million of net selling.

Despite heightened market volatility in the first half of the year driven by concerns over President Trump’s trade policies, the MSCI Asia-Pacific Index has risen about 8.8% year-to-date, outperforming both the MSCI World Index , which is up 5.4%, and the S&P 500 Index, which has gained 0.98%. – Reuters